Misuse of Community is Endemic in Web3

By now, even if you’re not super well-versed in the terminology of Web3, you’ve probably encountered some of the conversation around its relationship with community.

By now, even if you’re not super well-versed in the terminology of Web3, you’ve probably encountered some of the conversation around its relationship with community.

Like with any innovation or change in technology, there can and should be conversations about how Web3 will empower communities. However, we should also ask questions and think about how such change will impact communities, whether they embrace Web3 or not. For example, as Patrick and our guest, staff writer with The New Republic, Jacob Silverman discuss, NFTs may be empowering some artists, but for the DeviantArt community, it’s another way that they’re seeing their art exploited. And even for NFTs that are becoming ubiquitous, like Bored Apes Yacht Club, how much of the conversation or credit is given back to the artists?

This conversation will give you a great primer on Web3 terminology, but perhaps more importantly, it will equip you with questions and examples to understand the true role of community in the current iteration of Web3.

Jacob and Patrick also discuss:

- The basics of Web3, including cryptocurrency, NFTs, and DAOs

- Reasons why Web3 may not be as egalitarian as it seems

- Why celebrity cryptocurrency clubs of today may not have the same permanence as online fan clubs that already exist

Our Podcast is Made Possible By…

If you enjoy our show, please know that it’s only possible with the generous support of our sponsor: Hivebrite, the community engagement platform.

Big Quotes

Misuse of community in Web3 (1:35): “In Web3 … there’s a lot of use of this idea of community, but honestly, I find it’s often disingenuous when it’s coming from say a DAO that controls $300 million dollars worth of cryptocurrency or a crypto startup that has a lot of venture capitalist financing, and it has its own crypto token and an exchange. There’s just this appeal to this idea of community within Web3 that, if it were coming from a more traditional corporate setting, would ring very false to people.” –@SilvermanJacob

Disguising Web3 under the term “community” may get people to look past the risks (4:24): “[The use of ‘community’ in Web3] obscures the idea that these are, first and foremost, financial relationships, that there’s a lot of risk involved, and that the power relations may not be as egalitarian as the word ‘community’ implies.” –@SilvermanJacob

The supposed Bored Ape Yacht Club community (4:58): “[Bored Ape Yacht Club] is a billion-dollar company that employs several dozen people, is very well connected in Hollywood, whose own financial transactions and behaviors deserve some scrutiny. … If you just call it a community, you’re not going to really think about that. You’re not going to think about where are the conflicts of interests, who’s driving these markets, and what kind of power do I have as a member of the supposed community?” –@SilvermanJacob

What protections will Web3 offer for artists? (11:24): “OpenSea, for example, does not seem to be built to support artists and incentivize the small craftsmen type. Instead, OpenSea is meant to attract as many people as possible to mint NFTs, and it has very few guards against copyright theft.” –@SilvermanJacob

The utility of NFTs (45:00): “Maybe the utility of [NFTs] will grow, but right now you’re buying into a very hollow idea of community and connection for the promise of future rewards. Whether those rewards will even be worth it is an open question.” –@SilvermanJacob

The potential impermanence of NFTs (47:32): “There’s going to be some equivalent of link rot with NFTs and with some of these online communities. They’re going to break apart. They’re not going to be necessarily sustainable or haven’t proven themselves sustainable over the long haul, whereas the Dave Matthews Band message board that my college roommate used to post on is probably still around.” –@SilvermanJacob

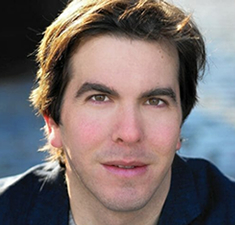

About Jacob Silverman

Jacob Silverman is a staff writer with The New Republic. He’s the author of Terms of Service: Social Media and the Price of Constant Connection, and is currently working on a book with Ben McKenzie about crypto and fraud.

Related Links

- Sponsor: Hivebrite, the community engagement platform

- Jacob’s website

- The New Republic, where Jacob is a staff writer

- Jacob Silverman on Twitter

- Jacob’s tweet that inspired this episode

- Terms of Service: Social Media and the Price of Constant Connection

- Bored Ape Yacht Club

- DeviantArt Protect

- DeviantArt Protect: 80,000 NFT Alerts Sent

- Here’s How DeviantArt Executives Are Tackling Theft and the Future of NFTs, via Gizmodo

- Jacob on CNBC and CNN

- Sam Bankman-Fried

- CZ Binance

- Ross Ulbricht NFT Collection Raises Over $6 Million in Ethereum, Free Ross DAO Wins Auction, via Bitcoin.com

- What exactly is the Jodorowsky’s Dune crypto collective trying to make, anyway? via The Verge

- Communities, Associations, and DAOs, written by Marjorie Anderson

- From a Meme to $47 Million: ConstitutionDAO, Crypto, and the Future of Crowdfunding, via The Verge

- Blockchain bridge Wormhole confirms that exploiter stole $320 million worth of crypto assets, via TechCrunch

- Which celebrity has the saddest NFT?, via Slate

Transcript

[music]

[00:00:04] Announcer: You’re listening to Community Signal, the podcast for online community professionals. Sponsored by Hivebrite, the community engagement platform. Tweet with @communitysignal as you listen. Here’s your host, Patrick O’Keefe.

[00:00:25] Patrick O’Keefe: Hello, and thanks for listening to Community Signal. “Misuse of ‘community’ is endemic in Web3,” so tweeted Jacob Silverman, staff writer for The New Republic in December. He joins us to discuss how crypto, NFT, and Web3 projects are using community terminology in a harmful way. If you haven’t heard of Web3 before, I’m sorry to be the one to disturb your bliss.

A big thank you to our Patreon supporters for stepping up for our show. This includes Rachel Medanic, Carol Benovic-Bradley, and Marjorie Anderson. For more info, please visit communitysignal.com/innercircle.

Jacob Silverman is a staff writer at The New Republic. He’s the author of Terms of Service: Social Media and the Price of Constant Connection. He is working with Ben McKenzie on a book about crypto and fraud. Jacob, welcome to the show.

[00:01:08] Jacob Silverman: Thanks for having me.

[00:01:09] Patrick O’Keefe: It’s my pleasure. You wrote a tweet back in December, actually, a lot of your tweets have caught my attention. I’ve enjoyed following you over the last several months, but there was one tweet, in particular, where you said that the misuse of community is endemic in Web3. What was going through your mind when you wrote that?

[00:01:26] Jacob Silverman: To be honest, I’m not sure which example prompted it, but I see this all the time, and I’m pretty certain the kind of thing that prompted it, which is that in Web3, which broadly is crypto, NFTs, decentralized finance, and also DAOs, the decentralized autonomous organizations that we see now, there’s a lot of use of this idea of community, but honestly, I find it’s often disingenuous when it’s coming from say a DAO that controls 300 million dollars worth of cryptocurrency or a crypto startup that has a lot of venture capitalist financing, and it has its own crypto token and an exchange or whatever else. There’s just this appeal to this idea of community within Web3 that if it were coming from a more traditional corporate setting, I think, would ring very false to people.

[00:02:13] Patrick O’Keefe: Yes. I think the example, in particular, was about someone tweeting, “If you buy a Lamborghini, you’re part of the Lambo community.” I think that was what prompted–

[00:02:19] Jacob Silverman: Oh, I’m sorry, yes. That’s good too, I think, as an example because look, is there really a Lamborghini community where people who buy these six-figure sports cars are talking, hanging out? Maybe there’s some online message boards or things like that, but it’s just another very expensive luxury good, but one way in which Web3, I think, tries to bind people together in financial arrangements is through these appeals to community that you can have the Lamborghini, but you can also have the Lamborghini NFT and trade them among other Lamborghini enthusiasts or something like that and consider yourself part of a tenuously defined Lamborghini community.

[00:02:58] Patrick O’Keefe: Following casually as I have, I don’t know, can you be a Twitter user with a big tech following and actually follow casually? It feels like it’s like in your face regardless. So many people that I follow have said, “Oh, I’m going to mute NFTs,” or, “I’m going to mute Web3,” or whatever. What I’ve seen is they’ve become very adept at using community lingo, and in community tools, Discord is extremely popular, obviously, with NFTs and Web3. They’re very savvy in how they use the tools and try to bring people together to form a personal connection and play on those dynamics. What do you think is the harm of them calling those efforts community?

[00:03:39] Jacob Silverman: Well, there are a couple of things. One, I freely admit that I have a pretty strong crypto-skeptic take and skepticism of Web3 in general. I think a lot of it hasn’t really proved its usefulness, a lot of it resembles gambling. There’s a lot of market manipulation. What I think community actually does is it obscures a lot of– one, it obscures a lot of the risks, and it makes it seem like you’re entering are a more welcoming space because, “Hey, these are all these people who can talk with you about your NFTs on Discord,” which– those areas certainly exist, and I wouldn’t necessarily take away from that, but you’re still part of these potentially complex and potentially very risky financial relationships.

I think it obscures the idea that these are, first and foremost, financial relationships, that there’s a lot of risk involved, and that the power relations may not be as egalitarian as the word “community” implies. It depends, of course, on the particular organization, or NFT collection, or platforms, or the details that we’re talking about, but again, I think you’re having these companies or even something like the Bored Ape Yacht Club is probably the great example of all this stuff, they define themselves as a community. Okay, fine, but certainly, they’re some rights and privileges of BAYC owners.

Also, this is a billion-dollar company that employs several dozen people that is very well connected in Hollywood whose own financial transactions and behaviors deserve some scrutiny and how they market themselves and the connections they have with celebrities and all this stuff. If you just call it a community, you’re not going to really think about that. You’re not going to think about where are the conflicts of interests, who’s driving these markets, what kind of power do I have as a member of the supposed community? That kind of thing.

[00:05:24] Patrick O’Keefe: I would consider you to be a pretty high-profile reporter on these issues. You’ve been on CNBC, you came on CNN a while back. So, are you already getting story tips in from people who are like, “I was taken in by this community and I put in this money and I didn’t realize it,” or do you think we’re still in that hype cycle right now where it needs to play out a little farther? Do you have people emailing you who’ll essentially be like, “I blew my money”?

[00:05:51] Jacob Silverman: Yes. I think we’re at both of those things. The hype cycle’s still going on. There are a few things you can point to. There is declining retail interest in crypto markets, which means that everyday folks who are being sold to via the Crypto.com ads with Matt Damon or whatever else are not showing up or putting as much money into crypto exchanges as they were, say, six months ago. That’s a problem for the industry, but that’s also going to bring more salesmanship.

The other thing in terms of getting tips, and to be honest, six months ago, I was less involved in reporting on crypto, I was doing some things, but now that I’m definitely more involved in it and I’m talking to folks more and I’m putting myself out there more in Twitter, I hear all the time from people getting scammed or people suffering the social effects.

A very nice guy messaged me yesterday, basically saying, without revealing too much, but his girlfriend lost her job, she’s in the music business or is a musician. A lot of people in the arts have been sold NFTs, one, as a community, but also as a way to make the money that’s been denied to them in the attenuated arts industry or culture industry like streaming music and MP3s took the money out of selling CDs and everything like that, and painters want to make money off of their art, so you have all these people who are saying, “Okay, NFTs are the way.”

This was someone who I talked to. His partner has been able to make a little money, but she’s personally exhausted by the constant hustle and the need to participate in all these communities. She’s always on Discord, she’s always selling, she’s always trying to appeal to investors, things like that. To describe these behaviors is not to necessarily denigrate them, I want to highlight how people feel these pressures to do these things and to sometimes participate in these communities or to sell themselves within these communities and rise within the community hierarchy.

That’s, I think, another thing worth noting is that there are these hierarchies, but yes, just to simply answer your earlier question, I hear from a lot of people these days, some of them are talking about just, “I got taken for a little bit of money,” or, “I regret this or that,” and some of them say, “You should really look into this NFT collection, which is selling for a lot of money and it seems very shady.” There’s different levels of scam and wrongdoing, I think, but I do hear that a lot.

[00:08:03] Patrick O’Keefe: One thing you mentioned was selling yourself within these communities. Something that I’ve been thinking about is one of the things that comes up when you try to, I think, critique these efforts is the success stories from the efforts like, “These artists made money finally, they’ve been struggling for years, and this is a gateway for them to grow their wealth,” which I think in some ways great for them, but if you take all the data out there and look at the marketplaces and the amount of things, NFTs, minted art, everything that’s out there, and how many have sold and how many are still selling and the volume of the sales and how many individual people are achieving a level of wealth from sales, I would just be curious to see if it was more akin to, say, unfavorable framing, but an MLM has some examples of like, “These people really did really well,” but then most of the people who try actually struggle or they don’t get the cost of minting back because they just minted it, they had to pay the gas fees, whatever it was, and they’re out that money and they never it back because just the sheer volume of art when I’ve gone on and pieces and digital work that I’ve seen when I go into these marketplaces and take a look around, it’s a staggering moment. I think it is a bit of a gold rush, but I don’t know that there’s a ton of gold. I guess I’d be curious what the data showed.

[00:09:15] Jacob Silverman: Yes. I think that’s a good way of putting it. There is a gold rush, but maybe there’s not a lot of gold underlying all this stuff. A couple of things you need to point out, which I think you’re really on to something here. One is that there is such volume. That’s partly because a lot of this stuff is automated. The algorithmically generated NFT collections sort of automate art. There are people who have real artistic interests and stuff. You can write the algorithm to design interesting art, but that’s a smaller portion of what we’re talking about here.

What we’re really talking about is a new kind of mass production and mass minting, especially because I believe OpenSea still doesn’t charge for the minting. I think they charge for the sale, so you can just mint everything. I don’t know if you’ve ever done anything about DeviantArt or looked at that-

[00:09:58] Patrick O’Keefe: Yes.

[00:09:58] Jacob Silverman: -on your show or anything like that–

[00:10:00] Patrick O’Keefe: You’re getting ahead of my notes, you’re getting ahead of my notes here. Please continue.

[00:10:02] Jacob Silverman: Oh, I’m sorry.

[00:10:03] Patrick O’Keefe: No, you’re good. Please continue.

[00:10:05] Jacob Silverman: Okay. DeviantArt, which I don’t know a ton about, but strikes me as a long-standing successful online art community.

[00:10:10] Patrick O’Keefe: 20-plus years old.

[00:10:11] Jacob Silverman: Yes, been around forever and doing their thing. They have a lot of artists there and they have this automated tool that they developed to spot copyright infringement, I think, and now it’s being applied to NFTs and OpenSea and some folks know. What you see is just DeviantArt being reproduced in mass on OpenSea. Some people who do believe in this technology or these kinds of markets say, “Oh, well, this is just an archaic early stage. We’ll develop more curatorial functions where people will be able to send takedown notices,” but it doesn’t seem engineered for that.

I think in terms of the economics and how it plays out, I think it will be like Spotify or some of these other streaming platforms or centralized platforms which is that there’ll be a few nice success stories, and you will always be able to point to that, there’ll be a few people who have the sponsorships from the platforms or the equivalent of the paid TikTok stars and influencers. There’ll be a lot of people who’re making dollars and cents and not really profiting. I think it doesn’t have the feel and I expect the data to be backed up, it certainly doesn’t have the actual qualities of an egalitarian market.

Also, you just need to look at how much scamming there is already, how OpenSea, for example, it does not seem to be built to support artists and incentivize the small craftsmen type. Instead, OpenSea is meant to attract as many people as possible to mint NFTs, and it has very few guards against copyright theft and that kind of thing. I just think already you see the way these markets have developed that the economics are not very reassuring. There will always be success stories that are sold to us and some might be genuinely heartening, but in terms of creating new sustainable egalitarian or equitable economies, I don’t really see that happening.

[00:12:00] Patrick O’Keefe: Yes, I think you raise a good point as far as pillaging these online art communities that have existed for a long time because they are rife for that. They’ve, of course, dealt with massive copyright infringement in the past, people selling their stuff on print-on-demand stores and all those sorts of things. They’ve lived through those revolutions of content creation and automated sales and creative works you can easily just print and sell.

DeviantArt, as we mentioned, a community 20-plus years old, and they launched this feature called Protect that scans public blockchains and third-party marketplaces for member content and notifies the member who posted the content on DeviantArt of infringement. The artist can then file a takedown request. Through January 4th, DeviantArt said they had sent over 80,000 alerts since August and were scanning 3.8 million new NFT images every week. From the reporting I write, it sounds like DeviantArt may eventually want their own piece of the NFT rush, but for now, they’re focusing on detection.

You mentioned and then I was going to mention it, it’s just an example of, as you said, this long-running community where members are saying their work’s bought and sold and there’s not a whole lot of recourse even around the takedown system for example. Because of the trustless system, once it’s sold, it’s sold. The crypto has been exchanged. OpenSea, from what I understand, I could find, keeps their fee on the sale unless they’ve changed. Then you’re not tracking down the wallet, so the money’s gone.

[00:13:20] Jacob Silverman: That’s another thing, keeping the fee. Just the built-in incentives, I think, perhaps is a simpler way of putting it, what I was trying to describe earlier, it’s just the incentives that as built into these markets and these protocols do not favor cooperation or even forms of restitution you’re talking about. OpenSea doesn’t have much incentive to stop the stuff because they’re still collecting fees. I just find that kind of thing very concerning.

Also, when you can just point to say, “Oh, this is just how the code works or the smart contract was working its design,” or maybe the smart contract wasn’t working its design, but code is law in this world. I think that also stands in contrast or in conflict with an idea of community because shouldn’t you be able to work with one another or work beyond surrendering to a system and saying, “We have nothing we can do?” That is another way in which I think the idea of how one thinks about community is in conflict with how these Web3– these trustless, permissionless systems work. Aren’t communities supposed to be built on trust, or are they supposed to be built on trust in code? I think there are obviously more social groupings than programmatic code or financial groupings.

[00:14:29] Patrick O’Keefe: Yes, it has been interesting. Not to sound like a simpleton here and just say words have meaning and go onto a dictionary definition of trustless, but crypto, NFT, Web3 promoters, they push this idea of a trustless system as a benefit. I understand it, I get what they’re after, but the fact is that most if not all great online communities are built on trust. They tend to be places where trust matters quite a lot and most folks who are buying into these efforts are trusting people, I think, which is in some cases the sad thing.

They are trusting people promoting these efforts in a way that may not be justified. Once they get in the system and exchange the currency to crypto, they revert back to this trustless system. How can you help me when something goes wrong? I think there was a high-profile case of someone who had some– it might have been Bored Ape Yacht Club that had some NFTs that were taken from him in a way that was misleading. He got phished I think, and because he was high profile, OpenSea, at least just on their marketplace, which is again, not to get deep into the explanation of marketplace on top of blockchain on top of this, but on their site, they were able to recapture those things for him in a sense, but the average person with five Twitter followers who joined a Discord, it’s much like reality in some ways, which I think, is unfortunate. The powerful, wealthy, influential people have a different set of principles and a different set of authorities available to them sometimes. It seems like that’s also playing out here even with these trustless systems.

[00:15:58] Jacob Silverman: Yes. I think that’s very well put. You see the reproduction of power relations from traditional daily life in the crypto space. Sometimes they’re reshuffled a little bit. You’ll have some random guy who owns a ton of Ethereum being very powerful in one community alongside a crypto executive, who also owns a lot of Ethereum, but speaking generally, the crypto economy is built on hype and on followers and influencers and celebrity and stuff. You can go on Twitter and Discord, especially, and see NFT influencers or people who control access to NFT collections offering to whitelist people, meaning to give them early access to an NFT when they’re dropped or minted. That’s of course great if you have the NFT when they start trading. You can potentially sell at the top of the market, especially if the top happens early.

[00:16:44] Patrick O’Keefe: Yes. It’s great when you get it for free. The only crypto I’ve ever had, I was given for free. It’s great that that I had this thing that I have zero value invested in that maybe I could extract money from someone else for and make a profit. What a beautiful system.

[00:16:59] Jacob Silverman: Yes. You still have familiar types of power relations, but also, you have these brokered relationships and people performing or doing micro-labor or doing little tasks on Discord to get access to the stuff that actually has value. I think you’re exactly right, which is that someone who joins a crypto Discord or something like that is probably going to have to put in a lot of work in one form or another, whether it’s just time talking to people or actually jumping through all these hoops that are required to get whitelisted for an NFT collection. It’s not Joe Shmoe with five followers can come in and immediately be a “normal” or regular part of this community.

[00:17:35] Patrick O’Keefe: Certainly not a whale, right?

[00:17:37] Jacob Silverman: Yes. They’re not going to be a whale. Also, in a practical sense, say it’s a DAO or something like that that has governance tokens, those are often related to how much crypto you own, or basically how much money you put in, how relations are stratified there. If you just come into a new organization like in real life, but if you don’t have that much money or stake in it, you’re not going to be a fully paid-up member or as powerful a member of an online group.

[00:18:03] Patrick O’Keefe: Could I trouble you for a quick description of a whale for my audience?

[00:18:06] Jacob Silverman: Sure. A whale is someone who owns a large amount of cryptocurrency in this case. It’s used in the context of gambling. I often say that crypto has a lot of parallels with gambling, casino capitalism. I don’t know what the monetary threshold is, but it’s either someone who owns a big chunk of a cryptocurrency or, say, if they’re owning some Bitcoin or Ethereum, if they’re in seven or eight figures or more, that’s probably a whale, but then you have really the mega whales, the people who are celebrities and influencers within the crypto world, some of whom own or run these companies, people like Sam Bankman-Fried who’s a billionaire many times over, or CZ, the head of Binance who’s believed to be one of the richest people in the world through his interest in Binance and his various crypto holdings.

When a whale comes into any crypto market, whether it’s an individual, or actually a trading firm could also be considered a whale sometimes, they have a lot of influence. When they jump in the water, it makes a big splash. They affect prices. They might be on the other side of a lot of trades. They are seen with awe and fear and respect.

[00:19:11] Patrick O’Keefe: Yes. They can manipulate the markets.

[00:19:13] Jacob Silverman: 100%. Yes.

[00:19:16] Patrick O’Keefe: Let’s take a moment here to highlight our generous sponsor Hivebrite.

Hivebrite empowers organizations to manage, grow, and engage their communities through technology. Its community management platform has features designed to strengthen engagement and help achieve your community goals. Hivebrite supports over 500 communities around the world, including the American Heart Association, JA Worldwide, Earthwatch, the University of Notre Dame, Columbia Business School, and Princeton University Advancement. Visit hivebrite.com to learn more.

The thing that strikes me about the use of community for the vast majority of these projects is just how cynical it is.

[00:19:55] Jacob Silverman: Yes.

[00:19:55] Patrick O’Keefe: Also, somehow obscenely ahistorical. It’s not even online community history which I am pretty well-versed on. Online communities have existed in some form, going back to some would say the ’70s. I’ve talked to people who were building digital communities over computer networks in the ’70s, even internet history, like simple stuff, avatars, pseudonymity.

There was this Reese Witherspoon tweet that got passed around. I like Reese Witherspoon, I appreciate her work, but she said, “In the near future, every person will have a parallel digital identity. Avatars, crypto wallet, digital goods will be the norm.” That’s an exact quote there. I’m thinking in the near future, 30 years ago, an avatar and an alternative identity is baked into the history of the internet. It’s what everybody did when they joined.

I joined the internet as a preteen. I think I was pre-COPPA in my first year. Child’s Online Privacy Protection Act didn’t even exist yet. I feel like that came a year or two later, but I wasn’t giving out my name on the internet. I was another person and here was my avatar. I was a green frog head on Twitter for my first decade on Twitter. It wasn’t an NFT. I didn’t mint it. It wasn’t in a hexagon, but I used an avatar, and just the overall nature of how things are, I don’t know what the terminology would be, but just taken and treated as new for this era when they’ve been existing for so long, part of it is hilarious, but part of it is just kind of offensive. I know you are someone who’s written about content moderation and Facebook and social and the web in a broader context too. That’s why I was drawn to you as a reporter, but yes, man, the internet’s been around.

[00:21:33] Jacob Silverman: I think both angles you’re approaching that from are right, which is that it’s ahistorical, but it also speaks to something else which is a tendency, I think, of tech and VCs, startups, and stuff like that. They want to seem like they’re on the cutting edge and they are inventing new things, even if they’re just digitizing or reinventing old things.

There’s the joke about how a few years ago, Lyft or Uber were always proposing the equivalent of a city bus or something like that. A lot of us are experienced with having avatars, online accounts, playing in different role-playing games, things like that, various forms of pseudonymity, and online representation and identity play, as part of what might be a genuine community often built around games or online message boards or forums or things like that. This is your bread and butter, I’m sure.

That is what’s a little frustrating when you see this stuff is they act like, “Oh, this is all new,” somehow. Even in the context of financial communities like investment clubs, community investment clubs have existed for decades probably or a century, where people from a town come together and invest in companies and make decisions as a group, and hopefully, profit off of real companies that produce real stuff. I’m sure some of those end poorly, but there’s this notion, I think, that because crypto is supposed to be emancipatory and revolutionary, that the communities around them are equally revolutionary or novel when, as you said, we have plenty of antecedents, and maybe useful ones that they should draw on in trying to form their own communities, but it’s an ahistorical approach.

[00:23:09] Patrick O’Keefe: It’s always a grand proclamation. You shared a tweet from someone that was like, “Web 2.0 leads with product. Web 3.0 leads with community.” I actually did a funny thing because every year– I’ve been moderating content since ’98, so 20-something years. Someone was like, “2022 is the year of community,” and it’s not even relevant to NFTs, it’s maybe part of the hype. If you go on Twitter and you search for a year and you put “of community”, every year people are saying, “It’s the year of this,” and it’s all part of the same hype cycle.

It’s just like NFTs are the current hype and Web3 and crypto is the current hype. It’s always part of the hype and we see it in– I guess every industry has the same thing, and that’s one thing about community that I try to get across is that we’re not some beautiful unicorn. We are just another industry and we have the same group of folks, good faith actors, bad actors, people who have good resources, bad resources, people who are in it for a quick buck, VCs flooded into community, I feel like, again in the last few years where they talk about community a lot and they want to be seen as influencers in the community space and be community-led and all these things.

It’s what it is, but it is often very cynical, and by the time that something else crops up, then the herd thins out a little bit, which I guess is true for all things in some way or another that get hyped from time to time. It’s funny to see the hype pass through the thing that you’ve done for a long time. I think a lot of folks who listen to this show have a similar experience.

[00:24:41] Jacob Silverman: I think it’s strange also if you just really think about what’s going on, why are billionaires talking about being in a community with you? You, me, average Twitter user, and do they really mean that? Unlikely. Also, we keep going back to this, but it is the leading edge example, Bored Ape Yacht Club, look, the celebrities who are buying into that each week and some for six or seven figures getting an NFT, one, they’re probably not paying full price for many reasons, but all these relationships are brokered. This speaks to the different access and hierarchies that we were talking about earlier. They’re not operating in the space in the same way. They’re being invited in. There’s money being changed, perhaps the NFT has given to them. It’s being brokered with agents and things like that.

It’s a very commercial, even professional transaction. The BAYC people now work with– his name is actually Guy Oseary, who’s a former manager for U2 and Madonna. This is a real Hollywoodized talent agency-involved agents, operation kind of thing. If I have a lot of money, which I don’t, but if I had 500 grand and wanted to go buy a BAYC on OpenSea or something, I could do that.

Even then with all my money, my valuable NFT, I’m not going to be the same level of status as some celebrity or as Paris Hilton who can go on a talk show and show her NFT and instantly rise in value and status within the community. It’s a very different dynamic especially when it’s so immediately tied to how much are you worth or how much money is in your pocket?

[00:26:09] Patrick O’Keefe: Yes. I live 15 minutes from Crypto.com Arena and I never thought I would have an affinity for the Staples brand.

[00:26:16] Jacob Silverman: I felt the same way. I used to be from Los Angeles and I felt the same way when reading that.

[00:26:21] Patrick O’Keefe: Well, is it Arena or is it Center?

[00:26:23] Jacob Silverman: I think it’s Arena.

[00:26:23] Patrick O’Keefe: Yes, and they changed– they even got rid of the Center, it’s an Arena now too, like, “Oh.” You mentioned DAOs earlier and we haven’t really touched on them much since. In the context of our conversation around community and wealth and what we’ve talked about, how do you think DAOs fit into this picture?

[00:26:38] Jacob Silverman: I think they’re increasingly important for DeFi, decentralized finance, and the organizations, they’re called decentralized autonomous organizations that seem to believe most in the permissionless trustless systems of crypto and DeFi and are willing to set up systems and protocols that people then stake their money to and then you hope for the best.

This is a vast oversimplification, but the point with DAOs is also that people have governance ability, that they have a vote over what’s going on, or maybe multiple votes depending on how much money they have, how big their stake is in the organization. It directly ties your financial interest to your voting interests, but this is supposed to be more democratic or egalitarian in the libertarian crypto vision.

One thing that’s interesting to me is, do people who are involved in DAOs have interests in so-called real life or meatspace in other forms of organization or self-organized stuff? Do they practice mutual aid? Do they volunteer for other organizations? Are they leftists or socialists in some way? I would wager that a lot of them are not, but I think it does appeal to people who frankly want some sort of community, but don’t necessarily want to get out of their chair, but also happen to believe in certain financial and technological principles about crypto and Web3.

One thing you have to note is that DAOs aren’t just about random people coming together and collaborating on some shared goal. They are that, but they all basically have attracted interest from big players in the industry. You have venture capitalists like a16z also known as Andreessen Horowitz, which is probably the most important venture capitalist in the crypto space. They are heavily invested in some DAOs, and they’re invested in DAOs that you think wouldn’t be of interest to a VC. They’re invested in a DAO that’s invested in another DAO that’s a criminal justice DAO that’s trying to free Ross Ulbricht, the Silk Road guy from prison. They’re invested in art NFT-collecting DAOs and things like that.

Some might say that that’s an interesting pivot for a for-profit corporation. I think what it means is also that these aren’t organizations that are defined around mutual self-interests and people gathering together. They also have a corporate element and corporate money suffusing them in lots of cases, and also means that, for example, a16z gets a lot of votes in the DAOs they belong to, and it might get a lot more votes than Joe Shmoe who just has a few tokens.

[00:29:04] Patrick O’Keefe: I’ll tell you what we’re seeing from the community space and what I see from– and I realize this sounds like a small pond within a small pond, but within our community industry hype artists, because there are some of them, DAOs are the future.

[00:29:16] Jacob Silverman: Yes.

[00:29:16] Patrick O’Keefe: There’s always a peer pressure to this stuff. NFTs, hype, FOMO. You’re going to miss out, get on the train. This is the time. You’re early. It’s still early. It’s still early now, even though all this has sold. It’s still early.

[00:29:27] Jacob Silverman: Yes, right.

[00:29:28] Patrick O’Keefe: We hear the same stuff in the sense of DAOs, like, “It’s early in DAOs. You need to get involved in it. This is how online communities will be in the future.” I think there are some smart people, which isn’t to say that DAOs are not something to consider for the future, but I think there are some smart introspective people doing this work that have said, “Let’s pause. Let’s learn what these are. Let’s think about the dynamics of community. Let’s see if they actually do support those dynamics.”

Friend of the show Marjorie Anderson wrote an article on Community by Association, we’ll link to it in the show notes, talking about this because she works in the association space. She’s hearing from people like, “Should DAOs be our new association community?” But when I read about DAOs and I hear about the best case of a DAO, which I think is an interesting concept because everyone always talks about what the best case of a DAO is, like, “If it works out or everything, this is how it should be. Everyone gets to say. Everyone can profit. Everyone can do this.” But in reality, when you put groups together and you try to manage a smaller online community or any space or group of folks, there is a degree of indecision that can strike with a group where everyone is making the choice and things cannot progress sometimes, and things don’t get moved forward and things get stymied.

There’s a reason I think that most online communities are– I say that in the sense of most, meaning that 99.9% of online communities you and I don’t know, they’re just small groups on the internet functioning healthily, doing their thing, they love knitting or they love fishing or whatever it is, and they’re healthy. They don’t have a Nazi problem, they moderate their content, and they didn’t want to grow exponentially. They didn’t have to reward VCs, so they just focus on what they like.

Some of those are professional, and they’re still healthy and they still don’t have a Nazi problem. They’re effective because they have a group of people who care about that community and have, in most cases, volunteered to shepherd it through various problems and moderate and take care of things as they come up.

It would be dangerous to say, “Okay, every decision we have to make about every post goes up to a vote.” There are some decisions you need to make, and of course, more influential people have more consideration of how those decisions are made, but with most communities, it’s a volunteer, moderator, owner, administrator. There’s just something about that nature of having to put everything to a vote or having people be financially invested that, I think, can work against the idea of a truly great online community. I don’t know where I’m going with this little rambling here, but it’s just interesting to see as the future of community is that you own a token-

[00:31:54] Jacob Silverman: You’re right.

[00:31:55] Patrick O’Keefe: -to participate in that community. That’s the future. I don’t know. There’s something that I don’t love about that.

[00:31:59] Jacob Silverman: That token has a value and can be traded for other tokens, some of which may then have governance privileges in other organizations and things like that. One of my main problems with Web3 writ large is that it’s the financialization of everything or you receive price tags and get tokenized and get traded that you may not want to be tradeable, and that may include votes or ability to participate in an organization.

[00:32:23] Patrick O’Keefe: When you talk about a16z or whatever, folks like that getting involved in DAOs, I think one of the things that we often try to do in online communities is– and this has come up with Joe Rogan. Joe Rogan and Spotify, Spotify gives him a hundred million dollars, publishes his show, people talk about that conversation in a moderation context because– I can understand why it makes some sense to draw the correlation, but moderation generally is when you have a group of people on a fairly even playing field and you apply standards to them fairly and equally. When you take one and you give them $100 million and you say, “This is exclusive to us now,” it’s not quite the normal community content moderation Section 230 dynamic. You are in a relationship with that person, that’s very specific, that’s around publishing his content. I think that when I look at these DAOs, this idea of financial incentive and being able to buy an outsized portion of votes and influence how things are run, and just the uncertainty of the buying and selling of those things too creates an instability around how the thing functions moving forward.

It’s very easy to kill an online community. You make a few bad choices, you change what it is, you make it suddenly totally different. Everyone’s already bought into the social norms. A decade later, you decide, “Hey, we’re going to totally switch it up.” You lose 90% of people. They leave, but with a DAO, you’re buying into it. There’s this financial incentive in a lot of cases. The shifting dynamic of it is if someone big decides to sell their interest in that community, then all of a sudden, someone else has an interest in the community, and maybe they have the biggest interest. Hostile takeovers are a weird dynamic to introduce into an online community.

[00:33:58] Jacob Silverman: I think that’s very well put, especially the fact that communities can collapse either quickly or over time, but what is underlying the DAO, and what is keeping people there and keeping them together? Well, the main thing is financial gain and financial interest, but also just a really outsized ambition to make a lot of money and sometimes with improbable interest rates, for example, on DAOs where you get to stake tokens, you get to stake stable coins, and they offer you crazy interest rates that you can’t get at a normal bank.

Inevitably, some of these DeFi protocols and DAOs and stuff are built on pretty unsound economic footing even by crypto standards, or you get what’s called a rug pull where one of the leaders of the project absconds with most or all the money. If those communities are based on such an uncertain foundation or really an unstable one, what’s keeping them together?

You see this a lot in the DeFi space which is that there’ll be some rug pull happen and someone will abscond with a huge amount of money like $50 million or $100 million worth of crypto, and you still get this language of community from the remaining people. The remaining couple leaders of the project who might also be totally unknown by the way because a lot of these people aren’t doxed, as they say, which– you and I both think there are benefits to being able to operate with different forms of anonymity and pseudonymity, but when you’re talking about a lot of money, perhaps you want to know who’s in charge of that.

Anyway, you’ll have the remaining leaders of a DAO say, “We really want to help the community and make this whole,” and stuff like that. That is when the language particularly seems insincere, I think. When everything hits the fan and there are huge problems and people are about to lose their money, then there are these appeals to community to basically to stay calm and keep your money there because they don’t want any more capital fled out. I think you’re right that when not only are the basic relationships financial but also built on a very unsteady economic foundation, it doesn’t really make for a sustainable or sustaining community, especially when the first disaster strikes.

[00:36:00] Patrick O’Keefe: Yes, and the future of gaming is play to earn. I don’t– I just can’t.

[00:36:04] Jacob Silverman: That’s depressing to me.

[00:36:05] Patrick O’Keefe: I just can’t. I play video games when I can, with my brothers, we’re on different coasts, and it’s one of the ways we stay in touch, and I play the game based on what they want to play or what we play together, and there’s a reason I don’t stream my entire life. My whole life isn’t work. It’s just depressing, but here’s what I’ll say. I know some people are probably listening to this and saying, “Patrick, DAOs are different than that. They can be other things.” Come up with a bullet list. “Not all DAOs are like this. We can give people tokens. There doesn’t have to be money exchanged. It’s just a dynamic,” whatever.

The question I would ask those folks if you’re thinking about DAOs, especially if you’re thinking about them seriously, is what do they make better? How do you feel that DAOs are improving the things that you’ve done in the past to build an online community that’s healthy, inclusive, and happy? Is there any part of a DAO that is making that better, or is it simply changing around the chairs on the deck? Is it– I don’t want to say the Titanic because you already have something good, but is it just reshuffling something for the purpose of sounding cool or changing something? Because what I think is going to happen with a lot of these communities is they’re probably going to hack in ways to make it more like how we’ve built communities online in the past.

For example, the issue of control shifting the dynamic of the community, well, that’s cool. Well, that just means the owner keeps 50% of the tokens or 51%, and then you say, “Okay, then you have a single voice who controls the community now, and whatever gets sold from the 49.9 of the tokens, then that’s fine because it’s not the majority.” You’re going to bake in systems that reinforce the things that we already know that work, and then call it a DAO and have tokens and have this extra layer of things, an extra layer of potential environmental impact, which we’re not talking about today, but is a whole other layer of this, and what is actually being made better?

So far, the arguments that I’ve seen have not convinced me that, in general, things are going to be made better by DAOs. Mostly I see them as some sort of– I think an investment club is a very smart way to think of them. Most of the ones that have crossed my radar have been people pulling together resources to do something else. Okay, but that’s not necessarily a community in the sense that we want to build or that most people, I think, listening to this show want to build.

[00:38:10] Jacob Silverman: I’m certainly open to suggestions that there are DAOs out there that should be examples for the field or the industry or this type of community. You hear this a lot in crypto, “Oh, we’re in this phase of anarchy and scammers and stuff, and we just have to flush a lot that out and the use cases will appear.” I genuinely think that Web3 has a lot more salesmanship and mysticism around the technology saying, “Blockchain is revolutionary than other consumer technology innovations of recent years.”

I think a reason there’s all that salesmanship and mystification, which is that this stuff hasn’t proved its usefulness, whether we’re talking about cryptocurrencies or NFTs or DAOs. Now, you can potentially argue that DAOs may have the most potential, but look at some recent high-profile examples. The Constitution thing was an embarrassing failure. The attempt by a DAO to buy the Constitution.

I mean, of course, it was bought by an even more cold-blooded capitalist, a hedge fund guy, and then people tried to get their money back, and a lot of people lost money due to gas fees and things like that or transaction fees. Then there was the recent Spice DAO that bought the copy of Dune, and I don’t need to get into all that, but a real misunderstanding of–

[00:39:17] Patrick O’Keefe: They bought a single copy of a book.

[00:39:19] Jacob Silverman: Yes. Real misunderstanding of how copyright law works. There are certainly ways in which DAOs can get people together to get excited about something and throw in some money, especially, no disrespect, nerdy folks who get excited about some geeky subculture thing like– I think the lost Jodorowsky’s Dune movie is cool, but they totally botched their attempt to buy it and do something with the IP, but yes, I’m not convinced.

I think that we need to stop thinking ahistorically, as we indicated earlier in this conversation, and say that you don’t need to reinvent the wheel and that there are a lot of useful examples of online community and that the dependence on code, and especially on trustworthy code– even though we say trustless and permissionless, someone audits the code. For example, there’s a big DeFi protocol, Wormhole, that just lost $320 million worth of Ethereum, supposedly because of an error in the code. They’re going to be made whole because they’re owned by actually a big crypto trading firm.

What does that do to a supposed community that just an error in a code can just wipe out everything pretty much in a moment? That doesn’t exist for an online message board about a game or things like that. I’m maybe wandering a little far afield here, but I think one also thing worth noting is that many of these companies, “community” is the buzzword now, but it used to be “democracy”, especially on the big platforms like Facebook. Facebook used to allow voting on policies and things like that. We always knew that that was a fig leaf. I think a similar thing can be said here with community and Web3 and these big companies.

Mark Zuckerberg is always going to control Facebook and what happens with Facebook, and frankly, a lot of these DAOs are going to be controlled at least 51% by a whale or a big stakeholder like you described. We have a long ways to go to see if they’re really these new forms of democratic association that were promised they are.

[00:41:13] Patrick O’Keefe: One interesting wrinkle to the gold rush is that there are people with actual communities of supporters who love their work, support them, that are being cashed out in a sense, as this celebrity, this person is hyping an NFT that they are buying into. We’ve talked a little bit about this, but you wrote a piece for Slate with Ben McKenzie about Yanni’s NFT club of all things.

The following portion really stood out to me. “The sad part about Yanni’s NFT club,” I won’t say the name, “Yanni’s NFT club is not fans being skimmed for another $40 or more, but rather the illusion of fellowship and access it promises Yanni listeners. Many of the fan videos invoke community and the possibility of convening with other fans, except that’s not possible.” Talk a little bit about the Yanni community and that dynamic of people buying into something, thinking there might be some community, but it’s really not.

[00:42:03] Jacob Silverman: Yes. I’ve been writing lately about crypto with Ben McKenzie, who’s an actor who has become a crypto skeptic too. He’s used to fame and the machinations of fame and stuff like that. We’ve been looking especially at celebrity and crypto, and how much this can be a celebrity-driven market. We wrote a piece about how Yanni’s NFT collection, the semi-ironically beloved global composer, he has this NFT collection where he sells access for, I believe, $40. Then you get an NFT membership card and then you can buy another NFT for 150 bucks, which is a cheap video thing. Then there are supposedly going to be other NFTs sold in the future, but everything seems very low rent and low quality.

There’s a pathetic sadness to it. One thing we wrote was that there’s not really a scam going on here. It doesn’t rise to that level where you’re really angry or you’re like, “How dare Yanni.” It’s one end of the spectrum where you can really see the stuff via the lens of community or the rhetoric of community has become a cash grab for every person with any fame really, and when it’s produced, put a lot of work into it, do it at the highest level of going on Jimmy Fallon and bragging about their new NFT, or something like Yanni where you’re just charging 40 bucks for this little digital key card kind of thing.

The other thing with the Yanni NFT is that it’s on basically a private blockchain. It’ll be almost impossible for anyone to sell them or trade them, which is against the ethos of NFTs. I think the thing is you are appealing to people’s genuine affections for artists, entertainers, celebrities, other people like that. That is one reason why people do buy into these communities sometimes. It’s not just for speculation or for the chance to make some money, but I think there’s a hollowness at its core of this idea of community and connection, whether you’re talking about the Yanni one where someone just spent 40 bucks or you’re watching Paris Hilton on Jimmy Fallon talk about her six-figure NFT.

That appeal to community and connection just rings very false to me. You’re not connecting with that person in any meaningful way. This may be just a feature of celebrity since time immemorial, but when you clearly put a monetary value on it, I think it’s even more glaring. The thing with the Yanni one is he has these video testimonials from fans who are saying how much they love Yanni and how they’re glad to be part of the NFT community, but it’s clearly just a few of them that they commissioned before launching the project.

There’s no message board there. There’s no way to submit your own video. It’s just really buying into this fan club where you get a JPEG, but in a sense, that’s what all these NFT clubs are, and all these NFT collections is paying some degree of money to buy into this community where you get a JPEG, ideally, one that you can sell later on and might make some profit off of, and they always promise you’re going to have access to other things. The BAYC people say they’re building a physical clubhouse. They’ve had some events. Look, maybe the utility of this stuff will grow, but right now you’re buying into a very hollow idea of community and connection for the promise of future rewards. Whether those rewards will even be worth it is an open question.

[00:45:13] Patrick O’Keefe: The Yanni one, it sounds like you’re just buying a video clip on a private website.

[00:45:18] Jacob Silverman: You are, it’s basically a private database, a private blockchain based on this Oracle technology. You’re not going to be able to take the NFT anywhere. There’s nowhere to post. It’s just a website dressed up with blockchain rhetoric. I suppose someone called it, I think, “Blockchain Lite” to me. It is a very cobbled-together thing. Again, it doesn’t mean Yanni is some villain of the industry or something like that because, again, he is not scamming people for a lot of money, but it shows just how everyone wants another revenue stream. This is seen as a way to do that. It’s done and sold to people with, “Get to know Yanni,” or, “Get to know Paris Hilton,” or whoever it might be, whatever level of fame they operate at, or whatever level of kind of seriousness as an artist or entertainer they operate at. It’s still sold via the same promises and the same rhetoric. I think whatever end of the spectrum of fame or benefits offered, you’re still ultimately kind of getting the same thing, which I think is rather disappointing.

[00:46:17] Patrick O’Keefe: There may be some fans that’ll run through a brick wall for Yanni, and after this, will keep-

[00:46:21] Jacob Silverman: Totally.

[00:46:21] Patrick O’Keefe: -continuing to give him money, but it seems no doubt, just on basic math, that there are fans who– this is the last straw. That 190 bucks or whatever it ends up being, 40 plus 150, or however much, is the last 190 that Yanni gets out of them. There are just so many ways to make money and so many ways to repackage your library or sell something or sell prints. I know photos Yanni took were part of it too. You could just sell prints with the photos. People would eat that stuff up. They’d pay $100, $500, $1,000 for a signed print, but to package it in this lingo and sell it in this way on this private blockchain and lock people into this other walled garden, I don’t know, it’s such a bizarre situation.

[00:47:04] Jacob Silverman: Everyone is used to some degree of crass commercialism. We all exit through the gift shop at the museum and things like that. I think what you said is exactly right. Why not just sell some prints? Why buy into the latest fad and do it in sort of a cheap way, and also, frankly, do it with technology that may not even be that usable in a decade?

I think one thing that we haven’t quite touched on, but maybe is worth mentioning at the end here is the potential impermanence of this stuff. There’s going to be some equivalent of link rot with NFTs and with some of these online communities. They’re going to break apart. They’re not going to be necessarily sustainable or haven’t proven themselves sustainable over the long haul, whereas the Dave Matthews Band message board that my college roommate used to post on is probably still around. It’s probably a more sustainable kind of community than the things we’re talking about here.

Besides having this sort of physical interaction with something that you can put on your wall, I think, what are fans really buying into? Are they buying into something enduring or something that will last or be of interest beyond tomorrow or next week? It doesn’t seem like it.

[00:48:05] Patrick O’Keefe: Yes. I have a martial arts community I’ve run for over 20 years now. It’ll turn 21 in three months. You can still look at the post from 21 years ago, and that’s not an uncommon story, the Dave Matthews Band forum. It’s definitely not an uncommon story. I think, again, it goes back to the idea of, what is made better, and if things are made better for people, then that’s something worth pursuing, but if things aren’t made better and it’s just sort of layering this financial incentive over it, the harm that’s created there is worth considering, and you consider it a lot. We don’t have a gift shop here on Community Signal, but we just have to exit.

Jacob, thank you so much for your time. It’s been a pleasure to chat.

[00:48:41] Jacob Silverman: It was great. Thank you.

[00:48:43] Patrick O’Keefe: We have been talking with Jacob Silverman, staff writer for The New Republic. Find him at jacobsilverman.com and follow him on Twitter @SilvermanJacob.

For the transcript from this episode plus highlights and links that we mentioned, please visit communitysignal.com. Community Signal is produced by Karn Broad and Carol Benovic-Bradley is our editorial lead. Until next episode.

[music]

Your Thoughts

If you have any thoughts on this episode that you’d like to share, please leave me a comment, send me an email or a tweet. If you enjoy the show, we would be so grateful if you spread the word and supported Community Signal on Patreon.

3 comments

Great conversation.

One thing worth considering, I think, is how finances have long played a role in managing communities.

E.g., take a community of interest, like an online forum, or a local meetup group. They cost money to run. Leaders/organizers usually cover the costs with advertising, sponsorship, maybe membership fees, or merchandise, or donations.

So it goes with web3, and with services like Unlock Protocol (https://unlock-protocol.com/), there’s practical utility/application, beyond buying and flipping them as speculative assets.

As folks learn how to spot and avoid scams, they’ll increasingly look at the communities first, then to the tokens as a virtual item, whether that’s buying the equivalent of a virtual membership card, or a stake in ownership/governance.

The thing I tend to ask is: What does it actually make better? Why introduce these additional layers, with these known risks, to systems where this action is already possible, where the site would still need to authenticate that the person is a member (or whatever), as it already does without the added points of failure?